Looking around the United States, once the richest country in the world as far as standard of living, we see bridges collapsing, major cities like Detroit going bankrupt, and according to this CBS News report – The highest infant mortality in the industrialized world. Michael Cohen asks in The Guardian:

“All of this must seem counterintuitive to foreign audiences. The US swaggers along on the world stage with a certainty and sense of moral purpose that no other country can match. Blessed with practically limitless national resources, a dynamic and diverse population, a relatively stable political system and innovative technological capabilities that other nations can only dream of, how can so many Americans be falling behind – and how can the nation’s leaders allow it to happen?

The answer is disconcertingly simple: we chose this path.

*

“It is the direct result of a political system that has for more than four decades abdicated its responsibilities – and tilted the economic scales toward the most affluent and well-connected in American society. The idea that government has an obligation to create jobs, grow the economy, construct a social safety net or even put the interests of the most vulnerable in society above the most successful has gone the way of transistor radios, fax machines and VCRs. Today, America is paying the price for that indifference to this slow-motion economic collapse.

It wasn’t always like this.”

(Referring to America’s historically strong middle class, Cohen continues)

“Life back then was never as idyllic as nostalgic portrayals of postwar America would suggest (this was particularly true if you were a minority or a woman). But it was also true that Americans enjoyed the type of economic security that current generations can only dream of.

Part of the reason was that they had political leaders who recognised that the federal government could not just sit on the sidelines. From the emergency measures of the New Deal, which laid the foundation for the modern welfare state, to the vast ambitions of the Great Society, the government provided support for the aged, healthcare for the poor, job security for workers, good schools for the nation’s young people and invested in science and infrastructure projects that created new economic opportunities. By the 70s, however, as the postwar economic boom began to deflate, so, too, did the idea that government had a role to play in stewarding the economy or protecting workers from the vicissitudes of the free market. Instead, as a conservative anti-government populism emerged out of the perceived “liberal” excesses of the 60s, a new political ethos came to the fore. It was one promoted by Republicans (if occasionally articulated and endorsed by Democrats). Government was no longer a friend to the working man – it was a malignant force transferring his hard-earned tax dollars to the poor and minorities.”—————————–

And so the intentional crashing of America had begun. Perhaps the first cut of the knife was to dumb-down American education and replace it with the propaganda of indoctrination. there was an all-out attack on public education. In “Americas Rotting Empire”, C.J. Werleman writes in Salon:

“America has the most billionaires in the world, but not a single U.S. city ranks among the world’s most livable cities. Not a single U.S. airport is among the top 100 airports in the world. Our bridges, road and rail are falling apart, and our middle class is being guttered out thanks to three decades of stagnant wages, while the top 1 percent enjoys 95 percent of all economic gains.

A rigged tax code and a bloated military budget are starving the federal and state governments of the revenue it needs to invest in infrastructure, which means today America looks increasingly like a second rate nation, and now new data shows America’s intellectual resources are also in decline.

For the past three decades, the Republican Party has waged a dangerous assault on the very idea of public education. Tax cuts for the rich have been balanced with spending cuts to education. During the New Deal era of the 1940s to 1970s, public schools were the great leveler of America. They were our great achievement. It was universal education for all, but today it’s education for those fortunate enough to be born into wealthy families or live in wealthy school districts. The right’s strategy of defunding public education leaves parents with the option of sending their kids to a for-profit school or a theological school that teaches kids our ancestors kept dinosaurs as pets.”

*

“There is a defined correlation between literacy, numeracy and technology skills with jobs, rising wages and productivity, good health, and even civic participation and political engagement. Inequality of skills is closely correlated to inequality of income. In short, our education system is not meeting the demands of the new global environment, and the outlook is grim, given the Right’s solution is to further defund public education while ushering kids into private schools and Christian academies aka “segregation academies.” The Republican-controlled South is where you see the Right’s education strategy in action. “Inspired by home-school superstars such as Creation Museum founder Ken Ham, tens of thousands of other southern families have fled their public-school systems in order to soak their children in the anti-intellectual sitz bath of religious denial.” In other words, we’re dumb and getting dumber.”

And again, Michael Cohen from the above quoted Guardian article:

“College tuition fees went through the roof as support for public universities declined. This was happening at the same time that a university degree became an essential ticket for success in a competitive global economy. A lack of early-childhood education and underperforming schools, particularly for the poorest Americans, meant that unless you’re in the top 10% of Americans chances are that when your child begins kindergarten, he or she is already one step behind.

This educational inequality is reflective of a larger trend of growing income disparities across US society. So, as Americans saw their wages stagnate, their economic anxieties increase, their debt levels skyrocket, their retirement savings shrivel and their future prospects dim, the very rich got much, much richer.

Yet, conservatism’s most pernicious impact came not from what it accomplished. There was no rolling back of the welfare state or the Great Society. The revered conservative Republican saviour Ronald Reagan railed against big government, but as president he found himself unable to zero out even a single major spending programme.”

—————————————

Michel Chossudovsky is Professor of Economics (emeritas) at the University of Ottawa, and runs the website globalresearch.ca –In an article titled “The Shutdown of the U.S. Government and “Debt Default”: A Dress Rehearsal for the Privatization of the Federal State System? – Professor Chossudovsky makes a persuasive argument that the crashing of America is intentional, and what it will lead to:

“The Bush and Obama bank bailouts had led to the appropriation of $1.45 trillion of US tax revenues. This money was channeled to Wall Street under Bush’s Troubled Assets Relief Program (TARP) and Obama’s bailout program initiated at the outset of his first term. This money was transferred to the banks.

Meanwhile, “defense expenditure” in support of a war economy had spiraled: 740 billion dollars had been allocated (FY 2010) to fund a vast process of militarization including America`s wars in the Middle East and Central Asia.”

*

“War and Wall Street”: Spiraling Public Debt

In the wake of the 2008 financial crisis, a new structure of public indebtedness had been created. Without accounting for the “black budgets” and “shadowy bank bailouts”, reported defense expenditures plus the bank bailouts amounted to a staggering 2.35 trillion dollars. Total revenue in FY 2010 was of the order of $2.38 trillion.

In other words, these two categories of expenditure, namely War and Wall Street “had eaten up” (together with interest payments on the public debt) the totality of federal government revenues.

The $2.35 trillion included the handouts to the banks plus military expenditure and the funding of the multibillion dollar DoD contracts with Lockheed Martin, Raytheon, Northrop Grumman, British Aerospace, et al.

No Money Left Over From the Public Purse to Fund Regular Government Programs

What this warped budgetary structure implied (in FY 2009 and 2010) was that there was no money (i.e. residual funds) “left over” from the public purse (tax revenues and other sources of federal government revenue) to fund regular government programs.

All other categories of expenditure including medicare, medicaid, social security as well as public investments in infrastructure, etc. had to be financed through debt creation (emission of Treasury bills and government bonds), namely through a dramatic increase in the public debt from $9.9 trillion in FY 2008 to 16.7 trillion (October 2013), a staggering increase of almost 70 percent.

In essence, the federal government has been financing it own indebtedness through generous handouts to Wall Street and the military industrial complex.

*

“Budgetary Shift: “Economic Shock Therapy”

“In a matter of three years, according to the CBO “forecast”, the budget deficit will be reduced from 7 percent of GDP in 2012 to 2 percent in 2015.

A budgetary shift of this nature can only be implemented by “economic shock therapy” leading to socially devastating cuts in public expenditure, which will inevitably result in a wave of civil unrest.

Built into these “forecasts” is the presumption that drastic austerity measures leading to major cuts in government spending will be carried out over a ten year period (2013-2022) thereby reducing the size of the budget deficit as well as its percentage ratio to GDP. We are not dealing with statistical concepts, the CBO “forecasts” through these 2013-20122 figures a process of fiscal disintegration and impoverishment of the American people.”

*

“In a bitter irony, while the Wall Street financial institutions were the recipients of the bailouts, they are also the creditors of the federal government, which had been precipitated into a structure of deficit financing controlled by Wall Street. This deficit financing –which was facilitated by Quantitative easing– is distinct from the Keynesian framework. It is controlled by the creditors. It does not create employment, it is not expansionary. It has little bearing on the real economy.

This post 2008 fiscal structure has had a fundamental impact on the process of debt formation. Tax and other federal government revenues had been assigned in 2008-2009 to bailing out the banks while relentlessly funding the war economy including the financing through black budgets of a growing number of Private military and security companies (PMSC).

The public debt has increased by almost 70 percent in five years, from 9.9 trillion in 2008 to 16.7 trillion in 2013 (October 2013 estimate of the debt ceiling, see graphs above).

The various phases of Quantitative Easing (QE) throughout the Obama presidency were largely intended by Wall Street to keep the ship afloat, with an increasingly larger share of the debt owned by the Federal Reserve (in the form of Treasury bills). The Fed has largely been involved in propping up its assets.

Under QE, tens of billions of dollars are injected into financial markets. Quantitative easing has not resulted in a positive stimulus of the real economy. “The real goal of the Federal Reserve is to guarantee the continual profitability of Wall Street and the personal incomes of the super-rich.”

*

“Were the Federal Reserve to be a publicly owned central bank, quantitative easing would have an entirely different dynamics: the government rather than the Fed (acting on behalf of Wall Street) would be calling the shots. Under a publicly owned central banking arrangement, two trillion dollars worth of public debt could be cancelled, thereby creating conditions for the funding of social programs.

The result of these macroeconomic reforms has been mass unemployment. The American people –including the middle class– have been impoverished by the Wall Street establishment, which ultimately decides on debt default and the statutory ceiling placed on the public debt.

Under pressure from Wall Street and the Federal Reserve, the choices of the US government are limited to the following options:

State programs can either be downsized, phased out or transferred out of the public purse to the private corporate sector, implying in all cases the layoff of tens of thousands of public employees.

*

“The Privatization of the American State?

The inevitable scenario established in the wake of the 2008 crisis is fiscal collapse, leading to:

the possible phasing out and/or curtailment of social programs, the privatization of large sectors of public sector activity.

The fiscal ceiling having now been reached, possibly with a deadline, the government is being pressured by its Wall Street handlers –who control decision-making in the US Congress– to curtail and downsize social programs as well as initiate the transfer of public assets and institutions into the hands of private corporations. There is also a movement to cut as well as privatize Social Security and Medicare.

The privatization of public monuments, museums, national parks, the post office, etc. has been raised in recent media reports as a possible “solution” to the debt crisis. But let us not be misled: the process of acquisition of federal public property including infrastructure and State institutions is likely to go much further.

The public sector is up for grabs. Wall Street will eventually go on a buying spree picking up State owned assets at rock bottom prices.

Ironically, the money transferred by the US government to Wall Street under the bailouts in 2008-2009 can now be used by Wall Street to buy out state property and assets. What this means is that the federal government not only finances its own indebtedness, it is also financing the privatization program (at tax payers expense), leading to the demise of federal government programs.

This process of privatization of the State is nothing new, it has been applied in developing countries under the helm of the IMF whereby state corporations are auctioned off and transferred into the hands of foreign corporations. It has also been applied in Eastern Europe as well more recently in several countries of the European Union.”

*

“All over the United States, politicians are selling off key pieces of infrastructure to foreign investors and big Wall Street banks like Goldman Sachs are helping them do it. State and local governments across the country that are drowning in debt and that are desperate for cash are increasingly turning to the “privatization” of public assets as the solution to their problems. Pieces of infrastructure that taxpayers have already paid for such as highways, water treatment plants, libraries, parking meters, airports and power plants are being auctioned off to the highest bidder. Most of the time what happens is that the state or local government receives a huge lump sum of cash up front for a long-term lease (usually 75 years or longer) and the foreign investors come in and soak as much revenue out of the piece of infrastructure that they possibly can. The losers in these deals are almost always the taxpayers. Pieces of America are literally being auctioned off just to help state and local governments minimize their debt problems for a year or two, but the consequences of these deals will be felt for decades. (Michael Snyder, American Dream, July 6, 2011)”————————————-

Professor Chossudovsky summed it up in a recent radio interview at KPFA in Berkeley, Wall Street is overflowing with cash and wants to turn it into hard assets. They intend to buy up Federal and municipal assets at “fire sale” prices.

But this plan was not only intended for the United States, it was a global scheme hatched by Larry Summers and Robert Rubin at the end of the Clinton administration, and it’s nothing short of a “new economic world order”.

Journalist Robert Parry has described how the plan to disrupt and restructure America was based on C.I.A. models such as that which overthrew the Allende Government in 1973.

“Over the past four decades or so, the Republicans have simply not played by the old give-and-take rules of politics. Indeed, if one were to step back and assess this Republican approach, what you would see is something akin to how the CIA has destabilized target countries, especially those that seek to organize themselves in defiance of capitalist orthodoxy.

To stop this spread of “socialism,” nearly anything goes. Take, for example, Chile in the early 1970s when socialist President Salvador Allende won an election and took steps aimed at improving the conditions of the country’s poor.

Under the direction of President Richard Nixon and Secretary of State Henry Kissinger, the CIA was dispatched to engage in psychological warfare against Allende’s government and to make the Chilean economy “scream.”

Greg Palast, a great muckraking journalist with old-school gumshoe style, has found a “smoking gun” memo that indicates how the plan to spread cancerous debt schemes across the world developed. From “Larry Summers and the Secret “End Game” Memo”:

“When a little birdie dropped the End Game memo through my window, its content was so explosive, so sick and plain evil, I just couldn’t believe it.

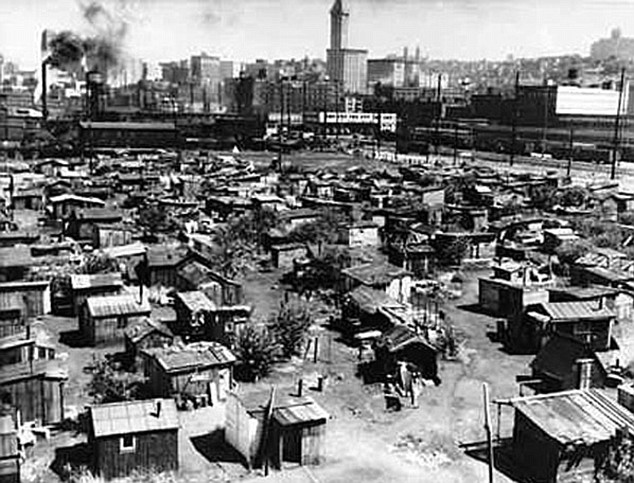

The Memo confirmed every conspiracy freak’s fantasy: that in the late 1990s, the top US Treasury officials secretly conspired with a small cabal of banker big-shots to rip apart financial regulation across the planet. When you see 26.3% unemployment in Spain, desperation and hunger in Greece, riots in Indonesia and Detroit in bankruptcy, go back to this End Game memo, the genesis of the blood and tears.

The Treasury official playing the bankers’ secret End Game was Larry Summers.

*

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: “derivatives trading.” JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as “assets.”

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet – in one single move. It was as brilliant as it was insanely dangerous.

How could they pull off this mad caper? The bankers’ and Summers’ game was to use the Financial Services Agreement, an abstruse and benign addendum to the international trade agreements policed by the World Trade Organization.

Until the bankers began their play, the WTO agreements dealt simply with trade in goods–that is, my cars for your bananas. The new rules ginned-up by Summers and the banks would force all nations to accept trade in “bads” – toxic assets like financial derivatives.

Until the bankers’ re-draft of the FSA, each nation controlled and chartered the banks within their own borders. The new rules of the game would force every nation to open their markets to Citibank, JP Morgan and their derivatives “products.”

And all 156 nations in the WTO would have to smash down their own Glass-Steagall divisions between commercial savings banks and the investment banks that gamble with derivatives.

The job of turning the FSA into the bankers’ battering ram was given to Geithner, who was named Ambassador to the World Trade Organization.

*

“The new FSA pulled the lid off the Pandora’s box of worldwide derivatives trade. Among the notorious transactions legalized: Goldman Sachs (where Treasury Secretary Rubin had been Co-Chairman) worked a secret euro-derivatives swap with Greece which, ultimately, destroyed that nation. Ecuador, its own banking sector de-regulated and demolished, exploded into riots. Argentina had to sell off its oil companies (to the Spanish) and water systems (to Enron) while its teachers hunted for food in garbage cans. Then, Bankers Gone Wild in the Eurozone dove head-first into derivatives pools without knowing how to swim–and the continent is now being sold off in tiny, cheap pieces to Germany.

Of course, it was not just threats that sold the FSA, but temptation as well. After all, every evil starts with one bite of an apple offered by a snake. The apple: The gleaming piles of lucre hidden in the FSA for local elites. The snake was named Larry.

Does all this evil and pain flow from a single memo? Of course not: the evil was The Game itself, as played by the banker clique. The memo only revealed their game-plan for checkmate.

And the memo reveals a lot about Summers and Obama.

While billions of sorry souls are still hurting from worldwide banker-made disaster, Rubin and Summers didn’t do too badly. Rubin’s deregulation of banks had permitted the creation of a financial monstrosity called “Citigroup.” Within weeks of leaving office, Rubin was named director, then Chairman of Citigroup—which went bankrupt while managing to pay Rubin a total of $126 million.

Then Rubin took on another post: as key campaign benefactor to a young State Senator, Barack Obama. Only days after his election as President, Obama, at Rubin’s insistence, gave Summers the odd post of US “Economics Tsar” and made Geithner his Tsarina (that is, Secretary of Treasury). In 2010, Summers gave up his royalist robes to return to “consulting” for Citibank and other creatures of bank deregulation whose payments have raised Summers’ net worth by $31 million since the “end-game” memo.”

—————————————

What are we to make of all this?

Since the election of Ronald Reagan in 1980, the dismantling of all public resources in America has been managed like a C.I.A. operation. Public education has been derailed, contributing to lack of civic participation and understanding of the historical significance of Government programs. Republican strategist Grover Norquist famously stated that he wanted to “shrink Government to the size where he can drown it in a bathtub”. The means of that were the creation of fraudulent financial schemes that created a series of burst bubbles and bank bailouts with taxpayer money. The top financial companies loan that money back to the Federal Government at great profit. Money was made as the bubble inflated and later after it burst. Between the bailouts and the war economy, there is no money left for the long established social programs that people have relied on for nearly a hundred years. To protect American banking interests from foreign competition, The World Trade Organization was leveraged to require the global banking system to participate in this planned collapse. Germany has now made southern Europe it’s own personal Mexico.

At home, Wall Street is sitting on too much cash, and it desires to purchase the assets of the Federal Government – assets already paid for by taxpayers – at “fire sale” prices.

The “End Game” is the complete privatization of the Federal Government – as Professor Chossudovsky calls it – a “proxy state”.

Meanwhile, Homeland Security is preparing for the expected widespread civil unrest when this scenario unfolds in the coming years.

One other demise in middle-class American culture is the breaking apart of unions and the legislation to take away workers’ ability to negotiate for better working conditions and pay!!!

Thank you for this Dojo Rat!